Written by:

Earlier this month, the news broke that Croydon Council had declared effective bankruptcy, citing the impact of Coronavirus and financial mismanagement [1]. With pressures on public spending hitting the headlines, and the looming (or current) threat of a financial crisis, I attended a Future of London roundtable (19 November 2020) chaired by Lisa Taylor about some different funding models available for public projects. We heard from several London boroughs, grant providers and fund managers about how investment is happening in 2020 and the compromises required to make it work.

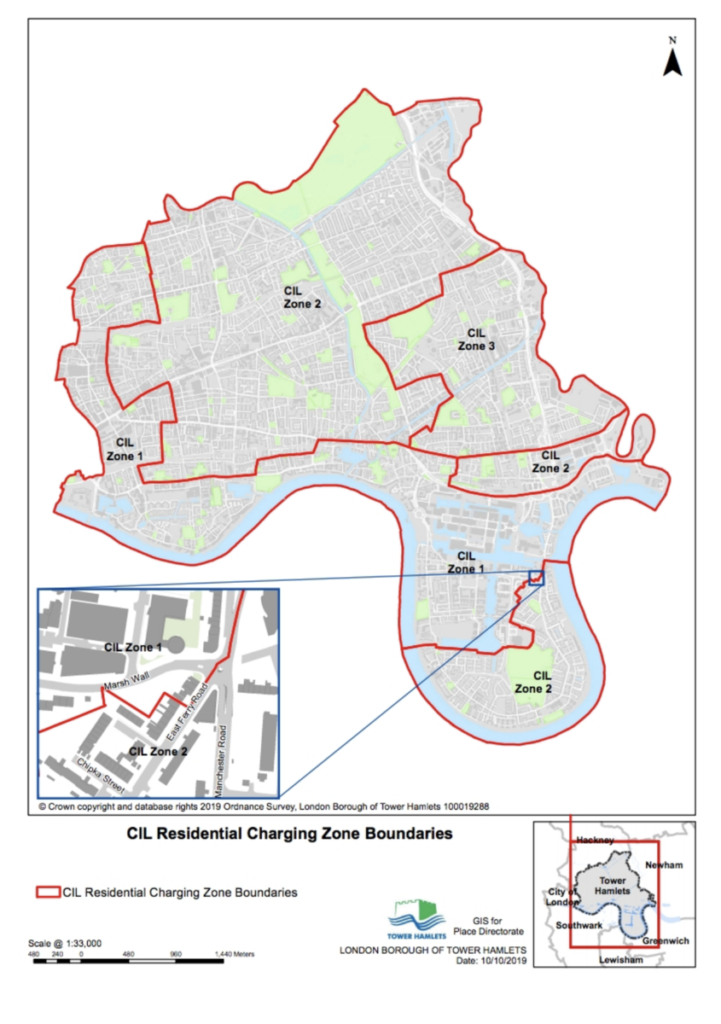

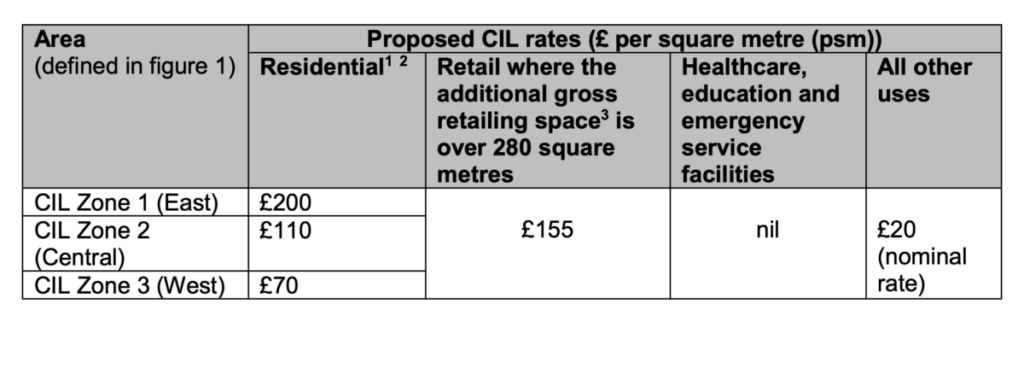

The Community Infrastructure Levy (CIL) [2] was much discussed as a significant source of funding for Local Authorities. Similar to a Section 106 agreement, CIL is a tariff paid by developers. Charges are zoned depending on the size of the development and the volume happening in the area, proximity to amenities like transport, or area-specific challenges, like the need to improve access to utility services.

Introduced in 2010, 33 London boroughs have now adopted the scheme, with receipts (the total raised by CIL) ranging hugely across London; from the highest at £143 million in one borough in 2018, down to just £700,000 in another. Along with GLA grants, CIL money has become something of a lifeline to cash strapped Local Authorities, who rely on the funding to mitigate some of the impact and disruption of regeneration projects and support investment in things like roads and town centres, transport links, or new green space.

To spend or not to spend

It was interesting to hear about the significant challenges faced by different boroughs, and the differing approaches to spending CIL money either as it comes, or by ‘saving up’ for larger projects. It can take several years to build a large enough pot for something substantial, which could mean little is happening by way of public realm improvements during that time. Professor Tony Travers, from LSE Cities made the point that Local Authorities need to get better at communicating this dynamic between development and investment to residents, as it is often the lowest income areas who bear the brunt of invasive and lengthy development work without seeing any of the short-term benefits, especially if funds have been allocated to infrastructure improvements signposted years down the the line.

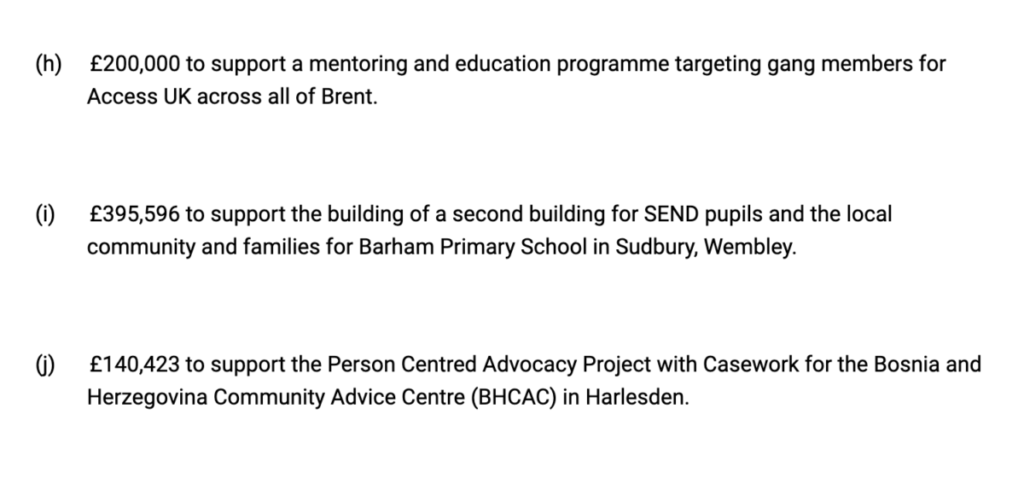

The London Borough of Brent goes someway towards addressing this. The Neighbourhood Community Infrastructure Levy (NCIL) allocates at least 15 per cent of CIL money to grants for community projects that ‘support the regeneration of the borough’ and are agreed in consultation with the community [3]. NCIL allocation varies between the five CIL Neighbourhoods in the borough.

Other ways to fund

Also in Brent, we heard from Alice Lester MBE in Brent, where they have built a sizable CIL pot and fostered new partnerships with external funding bodies. Due to a borrowing rate increase at the Public Works Loan Board [4], which used to be their primary source of funding, the borough have had to get creative. This approach has led to several new projects coming to fruition, including turning an ex-Wetherspoons pub into a community centre, buying a housing block for essential workers, a new adult learning centre and the purchase of several plots of land for housing development.

These cross-sector partnerships can be key to delivering investment, but require ambitious and demanding Local Authorities to deliver for community benefit. Bek Seeley of Lendlease Europe pointed out the lack of confidence in developing mixed use development strategies, and noted that stakeholders and investors need guidance in this field.

Retaining the local pound

Peter Matthew in LB Hounslow spoke of how deeply impacted his borough has been by Covid and Heathrow closures, with 40% of working age people currently unemployed. As a borough, they commissioned research early on in the pandemic to get a sense of where investment was most needed, and with a supportive finance team and a clear plan, were able to prioritise housing growth and construction. There was also a concerted effort to retain spending in the borough, for example by using local procurement for the council’s own spending activities.

Where is co-design?

Maria Adebowale-Schwarte from the Foundation for Future London spoke of working closely with communities to co-design grants to ensure they are resilient and respond best to community needs. Taking a similar approach to the way planning levies are allocated between departments could be transformative to the process.

A strategy for borough-wide spending, overseen by the community could help to ensure spending is impactful and the decision making process is transparent. In order to achieve this, it is important that we also invest in people to support our overstretched and underfunded public planning departments.

I left the roundtable with the sense that whilst the challenges are significant, there are research-led solutions available that are responsive to the needs of the community.

References and further reading

[1] ‘How Covid-19 pushed Croydon over the edge into bankruptcy’, The Guardian, 2020.11.13. Article here.

[2] Government Community Infrastructure Levy guidance. Available here.

[3] London Borough of Brent NCIL fund guidelines. Available here.

[4] Government guidance for Local Authority PWLB lending. Available here.

The Parks Trust, Milton Keynes community led trust greenspace.

‘Richard Desmond’s development company offers to pay £43m CIL charge for Westferry site’, Inside Housing, 2020.09.01. Article here.

‘Park life: harnessing the power of public space’, The FT, 2020.11.23. Article here.